Kustoff Questions Chairman Jerome Powell on the State of our Economy

Questions him on effects of USMCA, increased minimum wage, and the opioid epidemic

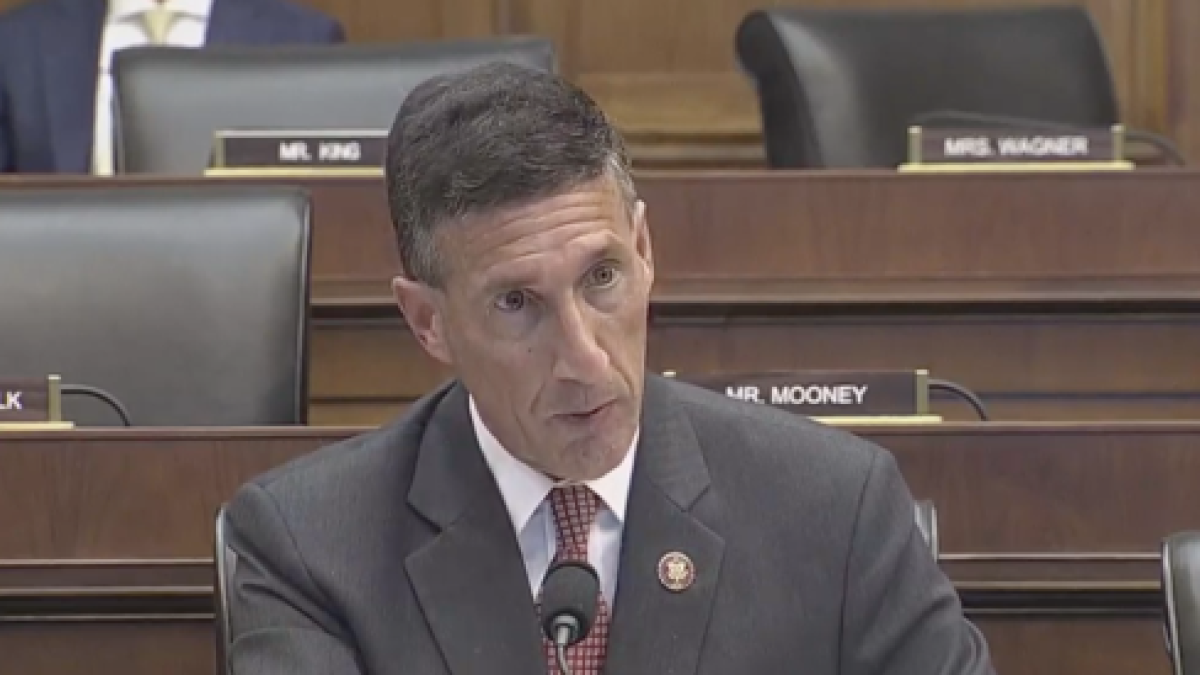

WASHINGTON, DC—Today, Congressman David Kustoff (TN-08), questioned Federal Reserve Chairman, Jerome Powell, in the House Financial Services Committee about the state of our economy. Congressman Kustoff asked him how the passage of the USMCA would help our farmers and businesses, how increasing the minimum wage will hurt our economy, and how the opioid crisis affects the workforce in West Tennessee and our nation.

Watch the full questioning by clicking here.

USMCA and Trade:

Kustoff: Thank you, Mr. Chairman, for appearing today. If I could, I would like to follow up on a line of questioning that Congressman Stivers had relating to the USMCA.

We are going to face the option of passing it or not passing it in this congress. What is the effect to our economy if we do, in fact, pass the USMCA and conversely what is the effect to the economy if we fail to pass the USMCA?

Powell: I don't actually have a precise evaluation for you of what the effects of passage would be. Overall, it's pretty similar to, to, you know, NAFTA. So, I would imagine that the differences will show up over the longer term. I think the effects of not passing it would really depend on what happens to NAFTA. If NAFTA were to then be terminated there could be quite a lot of uncertainty. There's some uncertainty now about what will happen.

I think the passage of it would remove that uncertainty and that's a good thing.

Kustoff: Would it also be positive for our farmers and agriculture communities if USMCA were passed?

Powell: Yes, I think it would.

Kustoff: Do you have an opinion how the passage or non-passage of the USMCA affects our leverage with china and negotiations and trade negotiations?

Powell: I don't. I don't think it will be appropriate for me to comment on those negotiations. I don't – I really don't have an answer for you on that.

Minimum Wage:

Kustoff: In next several weeks, reportedly we'll be voting on a proposal to raise the minimum wage to $15 an hour. There was a CBO report that came out in the last day or so that estimated that a raise in the minimum wage to $15 an hour should cut 1.3 million jobs, up to 3.7 million jobs. What would the effect be to the economy if congress were to raise the minimum wage to $15 an hour?

Powell: The question of the minimum wage is really one for you. I think the study, there are a range of studies that have different outcomes but like the CBO study what they tend to show is that a number of people get higher wages, and then there are people that lose their jobs.

Those numbers will change depending on what assumptions you make. There is no consensus among economists. Economists are all over the place on this. So, it's really a question for you to sort of look at. I would look at a range of studies and not take any single one. I would weigh that and say are the benefits worth the likely cost?

Kustoff: What's the effect to the economy if 1.3 million people lose their jobs or 3.7 million people lose their jobs as a result of the rise in minimum wage to $15 an hour?

Powell: It would depend on, again, there would be cost in benefits. Some people would get higher wages and they would presumably be better off and spend more. So, it's not a judgment that we make on net, it's a judgment you have to make that there will be people who are better off. And those are all the people who have the higher minimum wage. Other people will lose their jobs.

Kustoff: Would the federal reserve be concerned if 1.3 million people to 3.7 million people lost their jobs because the minimum wage was raised to $15 an hour?

Powell: Again, we do not take a position, we have never taken a position on the minimum wage. We would take whatever decision you make, as the decision that we would put in our models and take as a given. We wouldn't express either support or disapproval.

Opioid Epidemic and the Workforce:

Kustoff: When I'm back home in West Tennessee what I hear from employers, small, medium and large is that the economy is good. We're making money. We're making more money than we made in 20 or 30 years. However, we can't find enough employees. We can't find employees with soft skills. We can't find employees who have the skills we need for the jobs. We can't find employees who can pass a drug test.

Specifically, and you've talked about this publicly, the effect of the opioid crisis on the workforce. What is your feeling on that and how does the opioid crisis affect the workforce?

Powell: An extraordinary number of people are taking opioids in one form or another and it weighs on labor force participation, largely but not exclusively on younger males, also younger women. It's a national crisis, really. I mean there's the humanitarian aspect of it is completely compelling. But the economic impact is also quite substantial.