Congressman Kustoff Hosts Roundtables to Discuss Upcoming Tax Package in Congress

WASHINGTON, D.C. — On Monday, February 3rd, Congressman David Kustoff (R-TN) held roundtable discussions with local business leaders in Shelby County to discuss the upcoming expiration of tax provisions in the Tax Cuts and Jobs Act (TCJA) of 2017. The TCJA was made law during President Trump’s first term in the White House. This tax package was rocket-fuel for the American economy, incentivized business investment in the United States, and helped keep our country out of serious turmoil during the COVID-19 global pandemic.

The Tax Cuts and Jobs Act of 2017 allowed American citizens to keep more of their hard-earned money and is undoubtedly a signature legislative item of President Trump’s first term. Without Congressional action, many of the provisions in the Tax Cuts and Jobs Act are set to expire at the end of this year (2025). As such, Congressman Kustoff engaged local business leaders for feedback and dialogue on the tax provisions Congress needs to extend so that we can maintain a pro-growth, pro-business economy in America.

“At the end of this year, many provisions in the highly successful Tax Cuts and Jobs Act of 2017 are set to expire. If they do, every American taxpayer and business will face historic tax increases,” said Congressman Kustoff. “As a member of the House Ways and Means Committee, I am laser-focused on extending these provisions and ensuring the U.S. maintains a pro-growth tax code that benefits families, farmers, and businesses. Thank you to the local business leaders who attended my roundtable discussions and provided valuable insight for me to take back to Washington.”

Roundtable Attendees:

Sylvamo: Agnes Webb, Director, Tax Planning

FedEx Corp: John Dietrich, Executive VP/CFO

International Paper: Ken Goldberg, VP of Tax

Mid-America Apartment Communities: Stephen Woo, SVP of Tax

Mueller Industries: Joe Hardy, VP of Tax

First Horizon Bank: Hope Dmuchowski, Senior Executive VP/CFO

Orgill: Eric Divelbiss, Executive VP/CFO

Independent Bank: Missy Esnard, SVP and Controller

Bank of Fayette County: George Lumm, CFO

Landers Auto Group: Kent Ritchey, Founder and President

Sports Clips: Jeff Adkins, Owner of 28 locations

Boyle Investment Company: Mark Halperin, Executive VP/COO & Bo Lessley, Treasurer/CFO

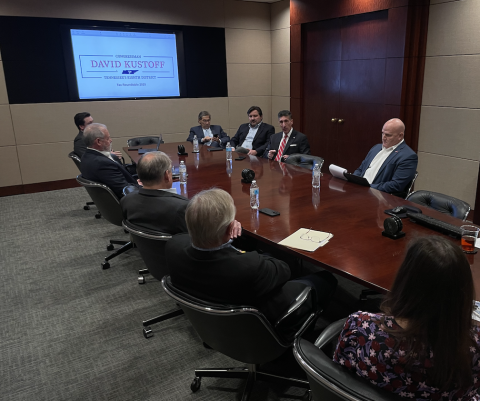

Pictures from the Day:

L to R: Joe Hardy, Stephen Woo, Agnes Webb, Ken Goldberg, Congressman Kustoff, John Dietrich, Hope Dmuchowski

L to R: Eric Divelbiss, Missy Esnard, Kent Ritchey, Jeff Adkins, Congressman Kustoff, Mark Halperin, Bo Lessley, George Lumm

Background:

In 2017, Congress passed the Tax Cuts and Jobs Act (TCJA) and it was signed into law by President Donald Trump. TCJA was the first major reform to the federal tax code in over thirty years, changing the individual income rates, the corporate tax rate, rules for estate and retirement planning, and taxes for small businesses. These Republican tax cuts brought relief to working and middle-class families and led to one of the strongest economies in U.S. history.

However, if Congress does not act by the end of 2025, these provisions, among others, will expire. That will mean a significant tax increase on virtually all American taxpayers and businesses. The House Ways and Means Committee is the chief tax writing committee in Congress. As a member, Congressman Kustoff will play a central role in tax negotiations.

###